Quaint Performance Review

Week 18

Dear Quaint Community,

This week, we experienced significant positive movements in our portfolio, and the broader market conditions showed notable shifts that influenced investor sentiments. Here’s a detailed breakdown of this week's performance alongside key market developments.

Strategic Portfolio Adjustments: Last week’s decision to adjust our portfolio, specifically the timely inclusion of a strategic asset, paid off with strong performance contributions this week, showcasing the agility and foresight of our investment strategy.

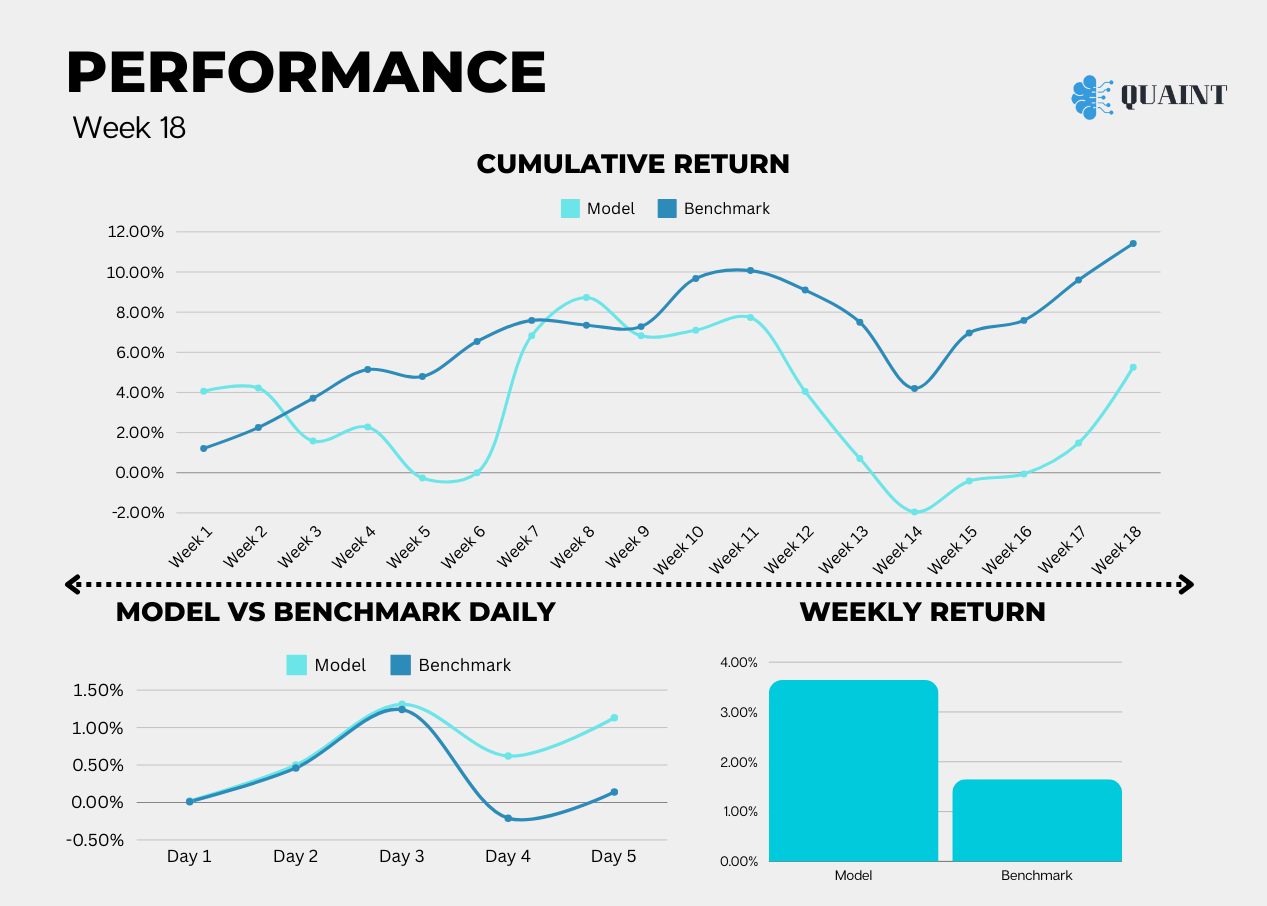

Weekly Performance Overview:

Day 1: Model: +0.02%, Benchmark: +0.01%

Day 2: Model: +0.50%, Benchmark: +0.46%

Day 3: Model: +1.31%, Benchmark: +1.24%

Day 4: Model: +0.62%, Benchmark: -0.21%

Day 5: Model: +1.13%, Benchmark: +0.14%

Total Weekly Returns:

Model: +3.64%

Benchmark: +1.65%

Cumulative Returns:

Model: +5.26%

Benchmark: +11.42%

Market Recap and Insights

Inflation Trends: The week was marked by a significant moderation in inflation pressures, a welcome change that has boosted market optimism. The Labor Department’s April CPI report came in at or modestly below expectations, breaking a streak of hotter-than-anticipated inflation readings. This softer inflation data has alleviated some concerns about aggressive rate hikes and has been supportive of growth stocks.

Equity Indexes Reach New Heights: The Dow Jones Industrial Average crossed the 40,000 threshold for the first time, while the S&P 500 and Nasdaq Composite also reached record highs. The rally in large-cap indexes underscores a renewed investor confidence driven by easing inflation and interest rate concerns.

Retail Sales and Consumer Spending: Despite flat retail sales in April, which fell short of the expected 0.4% gain, the market reaction was paradoxically positive. Investors interpreted the cooling consumer spending as potential relief from inflationary pressures, which could influence the Federal Reserve's policy decisions favorably for the markets.

Treasury Yields and Economic Outlook: Long-term U.S. Treasury yields fell in response to the latest growth and inflation news, reflecting a recalibration of expectations regarding the economic outlook and the Fed's interest rate trajectory.

Looking Ahead: As we approach a week rich with economic data, including further inflationary insights from PPI and CPI reports and a glimpse into consumer behavior via Retail Sales, we remain vigilant and ready to adapt our strategies to maintain alignment with the evolving economic landscape.

We thank you for trusting Quaint as we navigate these dynamic markets together. Our commitment to providing you with strategic, data-driven insights and effective portfolio management continues to drive our efforts.